Residential property market analysts at TwentyCi have been having some fun looking at the total value of all of the property in the UK and asking how much of it some of the world’s richest individuals could afford.

The UK currently has just under 31 million residential properties, with the average property price standing at just over £346,000. This means that the total value of homes in the UK is around £10.7 trillion, or £10.7 with eleven zeros, £10,700,000,000,000.

Using World Bank figures for UK GDP of £2.2 trillion per year, all UK mortgages could be paid off in five years, if no money was spent on anything else.

If we needed to secure a mortgage for all of the UK property, the income requirement of most lenders of four and a half times annual salary means that we could borrow £9.996 trillion and would have to find a deposit of £729 billion.

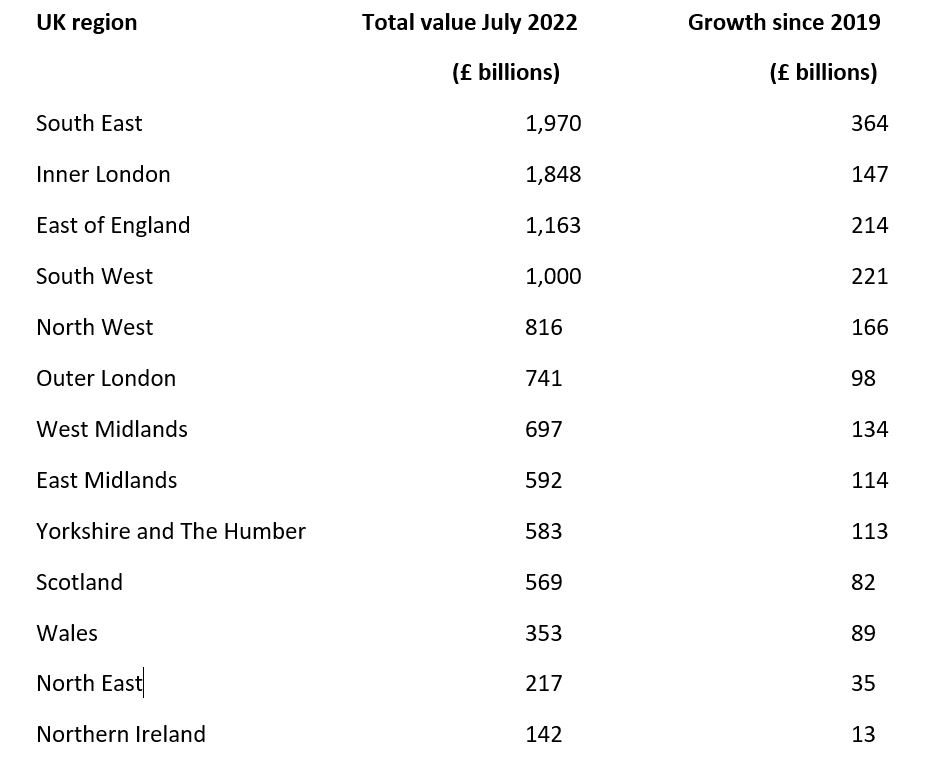

Property value by region

Who could afford to buy swathes of the UK?

Elon Musk, reported to be the world’s richest man and worth around £184 billion could afford Northern Ireland, but not any of the other UK regions.

Sir Paul McCartney is a long way from being able to afford Liverpool. With assets valued at £984 million, he would need to have 1,000 times that to purchase all of the properties, although he could buy all the residences on the Isle of Mull and Penny Lane with plenty of change.

JK Rowling is said to be worth £902 million, which leaves her £225 million short of buying all of the property in her home town of Yate, South Gloucestershire.

Lewis Hamilton is a long way from being able to afford his home town of Stevenage, which would cost £15.2 billion, with his current wealth of £224 million.

Contact us

If you would like to speak to one of our expert property lawyers, ring us on 0333 305 5189 or email us at info@lpropertylawyers.co.uk