LPL, like other conveyancers around the UK, are preparing for another peak in services demand as the announcement that stamp duty land tax (SDLT) would be cut as part of Kwasi Kwarteng’s mini-budget 2022.

This is a permanent cut which is effective from today, so it’s no surprise that Rightmove’s traffic soared within an hour of the announcement. It is the completion date, not exchange date, which is relevant, so completions which take place today can benefit.

“We’re cutting Stamp Duty Land Tax which will help more people to move, promote residential investment and boost first-time ownership. All alongside our housing supply reforms in today’s Growth Plan.” — HM Treasury (@hmtreasury) September 23, 2022

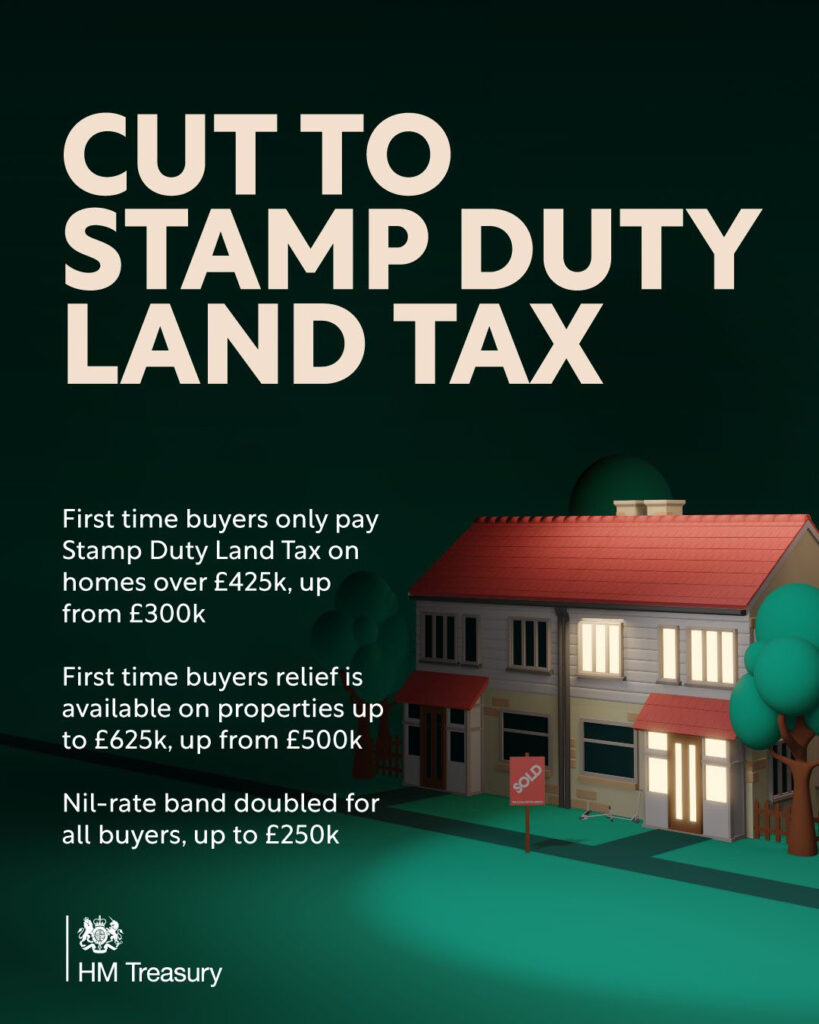

Key points from the announcement:

- Kwarteng is to raise the SDLT-free threshold from £125,000 to £250,000.

- For first-time buyers (FTBs) it will rise from £300,000 to £425,000.

- The value of properties upon which FTBs can claim relief will also increase from £500,000 to £625,000.

If you have any queries please contact your case handler or visit https://www.gov.uk/stamp-duty-land-tax to see the latest information from HMRC.