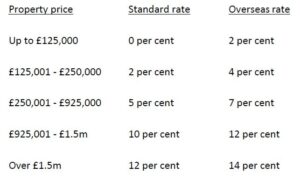

On 1 April 2021, the government introduced a new Stamp Duty Land Tax surcharge of 2 per cent for buyers of homes in England and Northern Ireland who are from outside the UK.

This means that overseas buyers will be required to pay an additional 2 per cent on top of the standard level of Stamp Duty payable. The surcharge applies to both freehold property and leasehold property where more than 21 years remain on the lease.

There is also an existing surcharge of 3 per cent payable by buyers who already own a property in the UK. The new 2 per cent surcharge is payable in addition to this if applicable.

Why the surcharge has been introduced

A substantial number of London properties are purchased by overseas buyers, resulting in inflated prices and difficulties for UK residents wishing to live and work in the capital. The government wishes to redress the balance for those who already work and pay tax in the UK and to make house prices more affordable.

The government has also said that money raised by the surcharge will be put towards reducing homelessness.

The residency test

Residency for the purposes of Stamp Duty will not be assessed in the same way as the statutory residency test used for other tax purposes. Instead, an individual will be classed as a UK resident if they have been in the UK for a minimum of 183 days during the 364 days prior to the date of the purchase.

If the surcharge is paid, but an individual subsequently satisfies the residency test in the year after the purchase, they may be able to apply for a refund. This must be done within two years of the date of purchase.

Joint purchasers

If a property is bought jointly with a spouse or civil partner, then if one of them is a UK resident the surcharge will not be payable. For any other joint purchase between buyers who are not married or in a civil partnership, all buyers need to be UK resident or the surcharge will be payable.

Exchanges before 1 April 2021

Where contracts for a purchase were exchanged before 11 March 2020, then the surcharge will not be payable, even if the completion takes place on or after 1 April 2021.

If contracts were exchanged and also substantially performed before 1 April 2021, then again, the surcharge will not apply.

Stamp Duty payable by non-UK residents

For second homes, a further 3 per cent should be added, making the top rate payable 17 per cent on property worth more than £1.5m.

If you are thinking of buying or selling a property and you would like to speak to one of our expert lawyers, ring us on 0333 305 5189 or email us at info@lpropertylawyers.co.uk